http://www.businessinsider.com/why-we-dont-have-hyperinflation-even-though-the-fed-has-printed-1-trillion-2010-2

Voltron's economics blog. Started in Iraq in 2007 as the "Gamblers Anonymous Support Group" email list.

Excerpt:

I have a few simple questions for all the dim-bulb economists now blaming the weather:

- "Did you not know there was a snowstorm on the East coast?"

- "If you did, then why didn't you factor it in to your estimates?"

- "How can you be surprised by something you knew?"

http://globaleconomicanalysis.blogspot.com/2010/02/nacent-recovery-or-nacent-economic.html

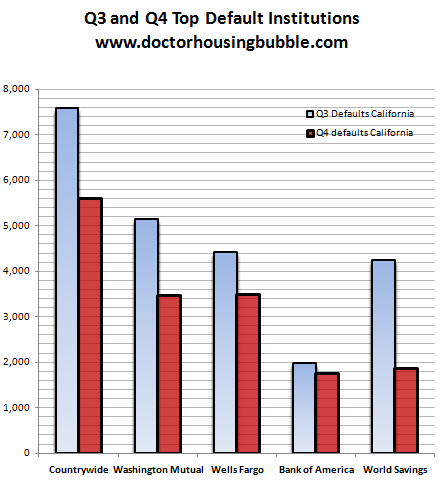

More than 10% of people with mortgages owe 25% more than their home is worth.

...In Nevada, 70% of mortgages were underwater. In California, more than a third of mortgages were underwater.

..."The rise in negative equity is closely tied to increases in pre-foreclosure activity," CoreLogic said. Once a homeowner owes 25% more than the house is worth, foreclosure rates rise sharply.

Negative equity exceeded 25% in six states and topped 20% in six others.

http://www.marketwatch.com/story/113-million-homeowners-underwater-on-mortgage-2010-02-23

The "Volker Plan" is officially dead:

http://www.nypost.com/p/news/business/volcker_fooled_iso6WHImNJiV1Vmk9FYm6L

The White House PR machine is working overtime to rehabilitate Treasury Secretary Tim Geithner's image including an interview in Vogue and cheesy photo ops with the first lady.

http://www.nakedcapitalism.com/2010/02/administration-ratchets-up-pr-campaign-for-beleaguered-emanuel-and-geithner.html

Former Federal Reserve Chairman Paul Volcker said the nation's home mortgage market is in trouble and will have to be "reconstructed."

"It's totally dependent, heavily dependent on government participation," Volcker said Friday in an interview with Bloomberg Television. "It shouldn't be that way. That's going to have to be reconstructed."

The federal government was responsible for up to 95 percent of all new home mortgages in the fourth quarter of 2009, said Guy Cecala, publisher of Inside Mortgage Finance, a leading industry publication.

"Anyone who looks at the numbers says, 'My God, look what it's come to,'" Cecala said in an interview Friday.

While Volcker hopes the nation's home mortgage finance system lessens its dependence on taxpayers, Cecala said it's going to be nearly impossible for a significant change to take place over the next year.

"We can't," Cecala said. "It certainly can't change in 2010. It's like saying we're going to make some improvements in the Titanic after it's hit the iceberg."

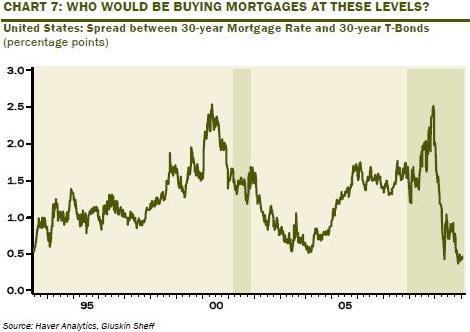

Voltron says: As I pointed out in the previous blog entry, there is no way anyone is going to lend money for houses at these low interest rates.

http://www.huffingtonpost.com/2010/02/19/paul-volcker-says-mortgag_n_469415.html

The WSJ reports today on a study that confirms what everyone has known for years: That many firms manage their earnings, pulling all manner of shenanigans to beat the street.

The way this form of fraud was detected was rather ingenious: The lower than mathematically expected incidences of the digit "4″ in corporate earnings releases. ("X.4″ to be precise) This simple statistical insight was due to an analysis of normal random distribution. "When the authors ran the earnings-per-share numbers down to a 10th of a cent, they found that the number "4″ appeared less often in the 10ths place than any other digit, and significantly less often than would be expected by chance."

Why?

By finagling the 0.4 to a 0.5, accountants then get to round up to the next higher number. Hence, 12.4 cents is "managed" to 12.5, which then becomes rounded to 13 cents per share.

They dub the effect "quadrophobia" — fear of fours.

A "youth against the banks" Facebook party at a Mayfair mansion in London was broken up by officers in riot gear last night after revellers pelted police with bricks and bottles. The teenage organisers of the party conceded that the event "got out of hand" when thousands more people than expected attended the five-storey squat in Park Lane.

...

The [organizers] started a Facebook group last Sunday urging people to "come and live the high life in a mansion on Park Lane". The party was billed as a "youth against the banks" event as the organisers believed the home was partly owned by HSBC. The bank has yet to confirm this.

"We wanted to shake things up because the banks are kind of running the worldwhich isn't fair," said Fox, a sixth-former from north London.

"We didn't break in, we got in through an open window. It's not illegal, that's just how squatting works," he said.

Members of the Facebook group, which has since been deleted, grew rapidly. "The idea was to invite a large number of friends not the whole of London youth . . . we personally only invited about 200 each. We then watched the group grow, it didn't seem real."

...The police estimated that "in excess of 2,000 people" attended the party.

Traders noting that Standard and Poor's is attempting to remove the Too Big To Fail premium that has been enjoyed by these large banks, which has been a major help to their credit ratings.

They are concerned the government may not step in should another crisis occur

The strategy is straight from "Unrestricted Warfare"

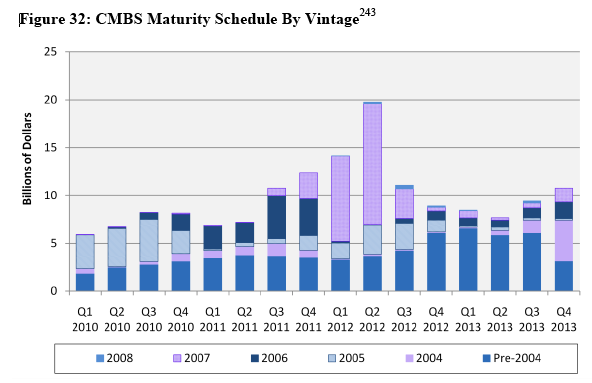

$1.4 trillion in [corporate debt] needs to be repaid or refinanced by 2014.

Companies with the weakest credit and the heaviest debts will have to pick up $800 billion of that tab. The rating agency Moody's calls the maturing debt an "avalanche."

http://www.forbes.com/2010/02/08/debt-bonds-banks-loans-markets-bonds-finance.html

Voltron says: If you don't believe it, watch "money as debt":

http://video.google.com/videoplay?docid=-2550156453790090544#

When mortgage modifications like Hamp come into play, that traditional priority order is reversed. The borrower is paying the Hamp-modified (i.e. lower) first lien amount, and the full second lien amount, so the second lien effectively becomes senior to the first.

When principal reduction comes into play, the problem becomes even starker. Current rules say that first lien mortgages can't be written down before the second.

http://ftalphaville.ft.com/blog/2010/02/05/143036/the-second-lien-sticking-point/

http://finance.yahoo.com/focus-retirement/article/108747/next-in-line-for-a-bailout-social-security

If you thought all the bank bailouts were over, take a look at what is happening with lenders' large holdings of junior, or "second-lien," mortgages.

These loans stand behind the first mortgage and, in theory, should take a loss before first mortgages in any workout aimed at keeping a borrower in a house. However, government programs aimed at making first mortgages less burdensome have left the junior loans largely unmodified, meaning in some cases the junior lender is basically getting bailed out for free.

"The wave of loan repurchase demands on securitization sponsors is the next area of fun in the zombie dance party, namely the part where different zombies start to eat each other," Whalen wrote in a note to clients Tuesday.

Treasury Department Is Already Saying "Volcker Rule" Won't Change Goldman Sachs