Voltron says: they said that housing prices never decline without unemployment increasing first. Well look out below . . .

Job Losses and Surge in Oil Spread Gloom on Economy

By PETER S. GOODMAN for the New York Times

The unemployment rate surged to 5.5 percent in May from 5 percent — the sharpest monthly spike in 22 years — as the economy lost 49,000 jobs, registering a fifth consecutive month of decline, the Labor Department reported Friday.

The weak jobs report, coupled with a staggering rise in the price of oil — up a record $10.75 a barrel to more than $138 — unleashed a feverish sell-off on Wall Street, sending the Dow Jones industrial average down nearly 400 points. The dollar plunged against several major currencies.

Investors’ recent hopes that the United States might yet skirt a recession sank swiftly in the face of gloomy indications that the economy is gripped by a slowdown and pressured by record fuel prices.

For tens of millions of Americans struggling to pay bills, the jobs report added an official stamp of authority to a dispiriting reality they already know: A deteriorating labor market is eliminating paychecks just as they are needed to compensate for the soaring cost of food and fuel, and as the fall in house prices hacks away at household wealth and access to credit.

“It’s unambiguously ugly,” said Robert Barbera, chief economist at the research and trading firm ITG. “The average American already knows that gas prices are up a ton and it’s really hard to find a job. Sally and Sam on Main Street are already well aware of this, and that’s why sentiment surveys are lower than they were in each of the last two recessions.”

About 1 in 11 Mortgageholders Face Loan Problems

By VIKAS BAJAJ and MICHAEL M. GRYNBAUM for the New York Times

About 1 in 11 American mortgages were past due or in foreclosure at the end of March, according to a report released on Thursday, a figure that is rising fast as home prices fall and the job market weakens.

The first three months of 2008 marked the worst quarter for American homeowners in nearly three decades, according to the report, issued by the Mortgage Bankers Association. The rate of new foreclosures and past-due payments surged to their highest level since 1979, when the group first started collecting the data.

All told, about 8.8 percent of home loans were past due or in foreclosure, or about 4.8 million loans. That is up from 7.9 percent at the end of December. (About a third of American homeowners do not have mortgages.)

Delinquency and foreclosure rates started rising from historically low levels in late 2006 and have picked up speed in nearly every quarter since. Analysts say at first past due mortgages represented mostly high-risk loans made to borrowers with blemished, or subprime, credit. Now, as the economy has weakened and home prices have fallen in many parts of the country, homeowners with better loans are also falling behind.

Economists worry that a big loss of jobs in the coming months could drive default rates much higher. The Labor Department will release its report on the job market for May on Friday.

“It’s not going to help the housing market out at all if you have a loss of jobs,” said John Lonski, chief economist at Moody’s Investors Service. “When employment’s contracting, that makes it all the more difficult to sell your home at an attractive price.”

Though defaults are rising in many places, it is worst in areas where home prices soared in recent years or where the local economy is now struggling.

California and Florida, for instance, accounted for nearly a third of all mortgages that were in foreclosure or 90 days delinquent. Home prices, construction and mortgage lending were particularly ebullient in those states earlier this decade. The housing industry accounted for a bigger portion of their economies during the boom.

“The problems in California and Florida are extraordinary, and they are the main drivers of the national trend,” said Jay Brinkmann, vice president for research and economics at the Mortgage Bankers Association.

Midwestern states like Michigan and Ohio, where home prices did not soar, are suffering mostly from the loss of manufacturing jobs and high-risk loans. Default rates in those states appear to have leveled off in the last few months, which may be an early hopeful sign.

About 9.7 percent of loans in five Midwestern states were past due or in foreclosure in the first quarter, down from 10.5 in the fourth quarter.

“This decade has been brutal on the industrial economies of the United States,” said Michael D. Youngblood, a mortgage analyst at Friedman, Billings, Ramsey. But “the rate of labor market deterioration in these depressed cities is significantly slowing.”

Michigan, Indiana and Ohio are still among the five states with the highest default rates. The other two states in that list are Florida and Mississippi.

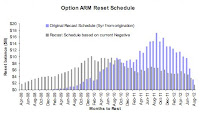

Defaults are highest for adjustable-rate mortgages — loans that promised a low, fixed-interest rate for the first few years. But people who took out such mortgages are falling behind even before those loans reset to a higher adjustable rate. Analysts say that reflects the fact that those mortgages were popular among investors, buyers who made small or no down payments, and those who did not provide proof of their incomes.

Falling home prices are also contributing greatly to foreclosures. Homeowners who owe more on their loan than their homes are worth are more likely to default if they encounter financial distress, said Robert Van Order, an adjunct finance professor at the University of Michigan.

In past housing downturns like the one in the early 1990s, he said, housing prices did not fall nationwide and even in local markets they fell much more slowly. So far, home prices have fallen about 16 percent from their peak in the summer of 2006, according to the Standard & Poor’s/Case-Shiller index. Economists at Lehman Brothers expect the decline to bottom at 25 percent.

“What that means now is people don’t have that equity cushion as they get into trouble,” said Mr. Van Order, who was once chief economist at Freddie Mac. “The incentive to beg, borrow and steal is not there.”

By many measures the job market is not falling apart; the unemployment rate was 5 percent in April. But these are challenging times even for those who have not lost jobs with gas prices at $4 a gallon, economists said.

“Wage increases are not keeping pace with inflation,” said Bernard Baumohl, managing director of the Economic Outlook Group. “That really puts a lot of pressure on households to make some very serious financial decisions.”

The surge in defaults has been challenging for mortgage servicing companies, which find it hard to keep up with the growing backlog of loans awaiting foreclosure, analysts say.

Some mortgage servicing firms appear to be holding off because lawmakers in Congress are talking about a plan to refinance up to $300 billion in loans using the Federal Housing Administration, Mr. Youngblood said. The discussions are “giving servicers hope of a better solution for many borrowers,” he said.

In states like California and Florida where they have huge inventories of repossessed homes, some companies are starting to move a little faster by auctioning off properties, Mr. Youngblood and others say. In some markets like Las Vegas about half the homes sold in recent months had been in foreclosure.

Dean Williams, chief executive of the auction firm Williams & Williams, said mortgage companies are most eager to hire his firm in markets that have a “rapidly and constantly increasing pile up” of homes.

![[Combo]](http://s.wsj.net/public/resources/images/MI-AQ789_HEARD_20080609191637.gif)