Source : http://www.thestreet.com/story/10552223/1/wells-fargos-balancing-act.html

Excerpt from another article explains:

from Wells Fargo's third-quarter 2008 release:

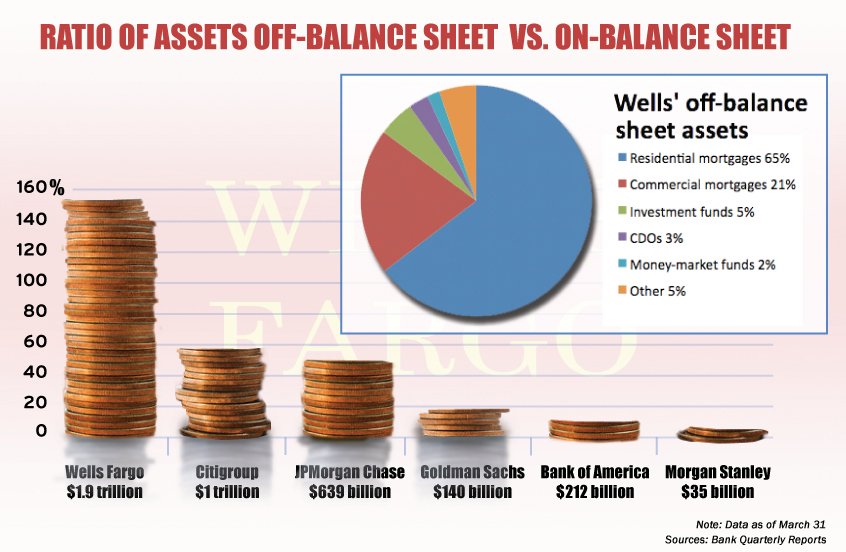

"Almost all of our off-balance sheet arrangements result from securitizations [of] home mortgage loans and other financial assets, including commercial mortgages. We normally structure loan securitizations as sales, ... This involves the transfer of financial assets to certain qualifying special-purpose entities (QSPEs) that we are not required to consolidate [on the balance sheet]."

Voltron says: They subsequently removed this note from future filings.

Voltron says: structuring loans as sales is exactly what Lehman ($50 billion) and Enron ($14 Billion) did, but this is on a much larger scale ($1,900 Billion)

http://www.minyanville.com/businessmarkets/articles/fre-fnm-mortgage-off-balance-sheet/2/2/2009/id/20901?page=2

No comments:

Post a Comment